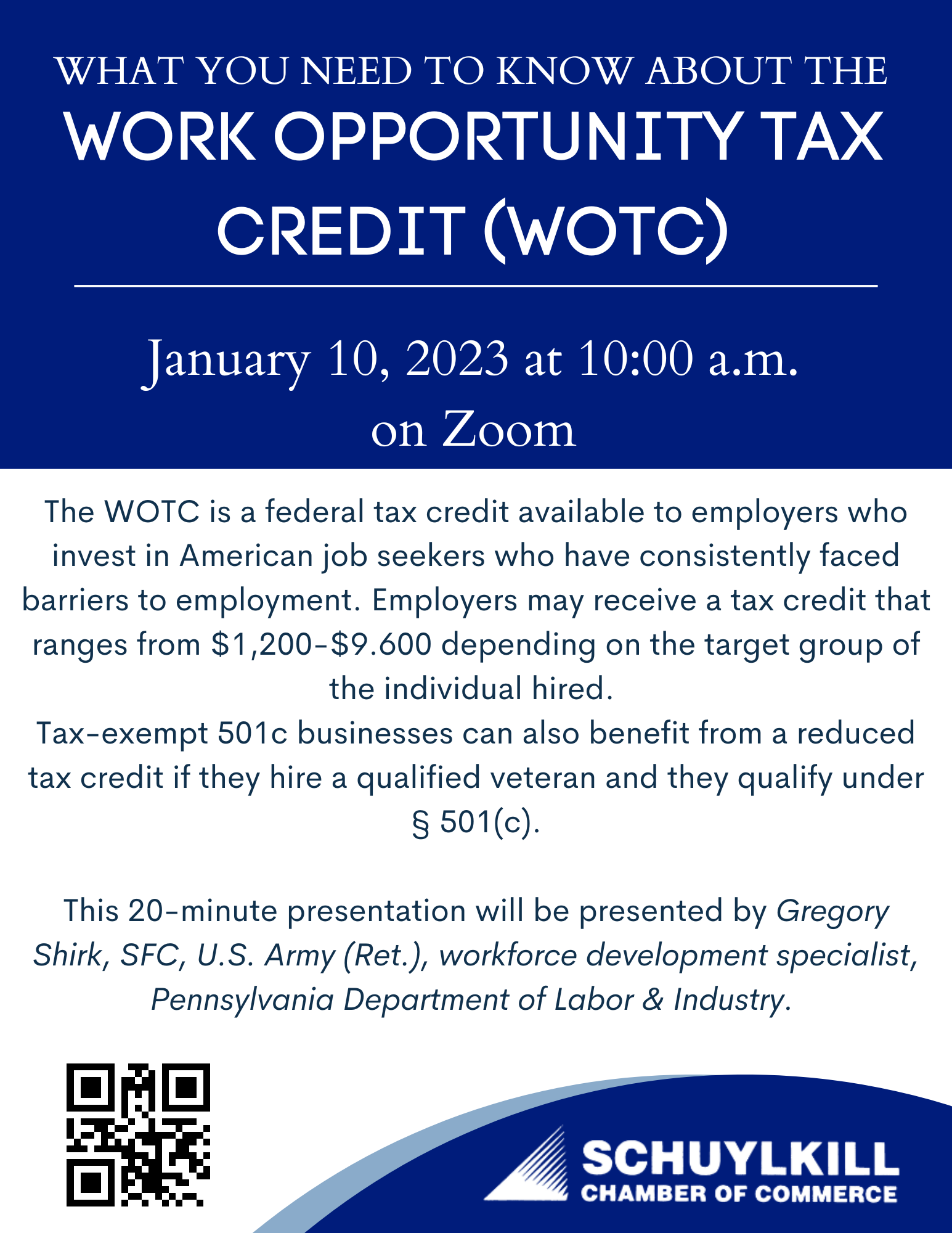

Work Opportunity Tax Credit (WOTC): What You Need to Know

Work Opportunity Tax Credit (WOTC): What You Need to Know

Tuesday, January 10, 2023 (10:00 AM - 10:30 AM) (EST)

Description

The WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. Employers may receive a tax credit that ranges from $1,200-$9.600 depending on the target group of the individual hired. Tax-exempt 501c businesses can also benefit from a reduced tax credit if they hire a qualified veteran and they qualify under § 501(c).

This 20-minute presentation will be presented by Gregory Shirk, SFC, U.S. Army (Ret.), workforce development specialist, Pennsylvania Department of Labor & Industry.

The presentation will be held on Zoom https://bit.ly/3UwnTyC and is hosted by the Chamber's Education Committee.

Images

Tuesday, January 10, 2023 (10:00 AM - 10:30 AM)

(EST)

Categories

Continuing Education

Continuing Education

Powered By GrowthZone